How to Add a Beneficiary in FAB Mobile – A Complete Guide

Introduction

Add a beneficiary in FAB Mobile app is an important step for easy and secure funds transfer. Whether you want to send money to the family members, friends or pay bills. You can set up beneficiaries with simple process which makes your future transactions faster. Adding a beneficiary in FAB Mobile helps you manage your transfers easily. After adding it, you can keep an eye on your FAB account balance to manage your transactions efficiently. In this guide, we will provide you with the step-by-step guide on how to add a beneficiary in FAB Mobile app which ensures you the ease of funds transfer.

Why Add a Beneficiary in FAB Mobile?

Adding a beneficiary to your FAB Mobile will give you the advantages of

Step-by-Step Guide to Add a Beneficiary in FAB Mobile

Below is a detailed step-by-step procedure of how to add a beneficiary using the FAB Mobile App:

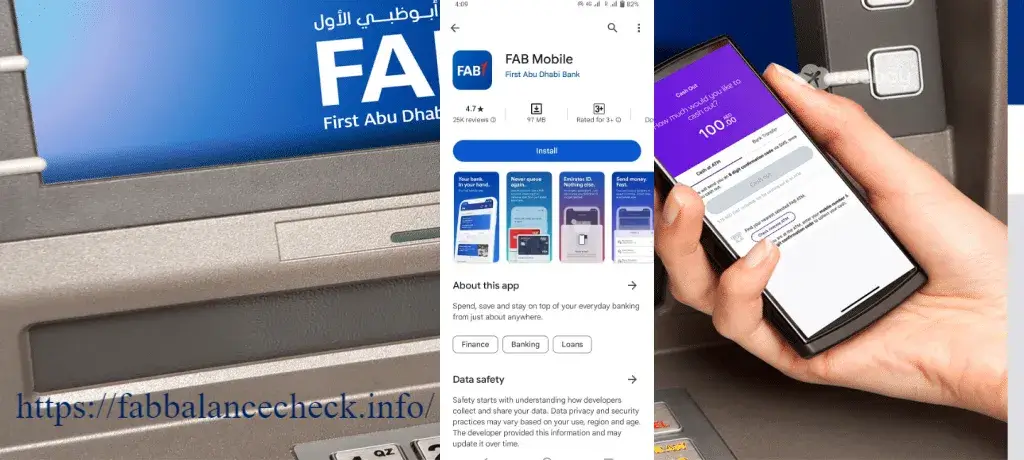

Step 1: Download and Log in to the FAB Mobile App

If you have not downloaded the FAB Mobile app in your mobile device yet, you can easily find it on the Apple App Store or Google Play Store.

If you have installed it:

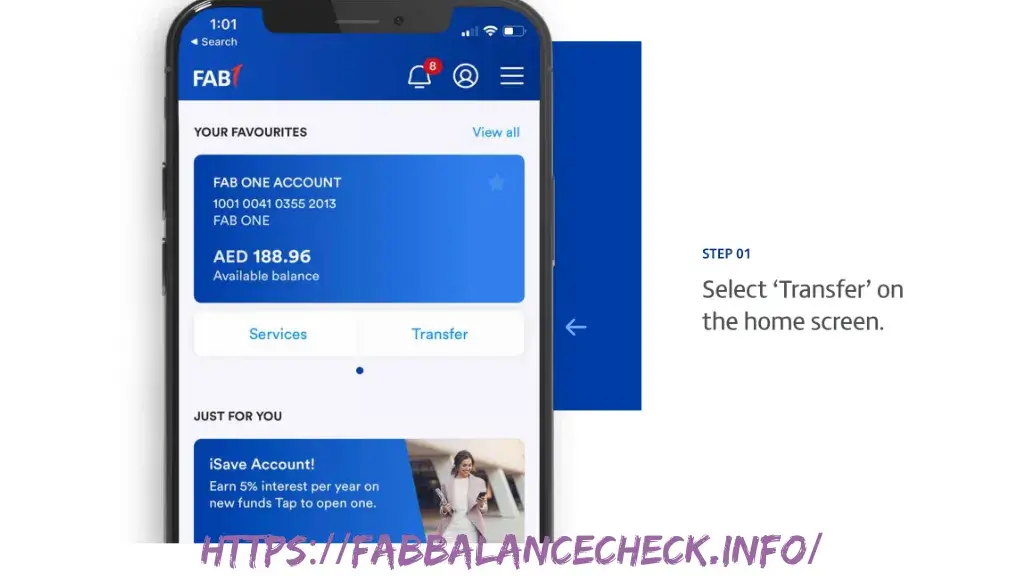

Step 2: Go to the Beneficiaries Section

Once you have logged in, follow the steps below:

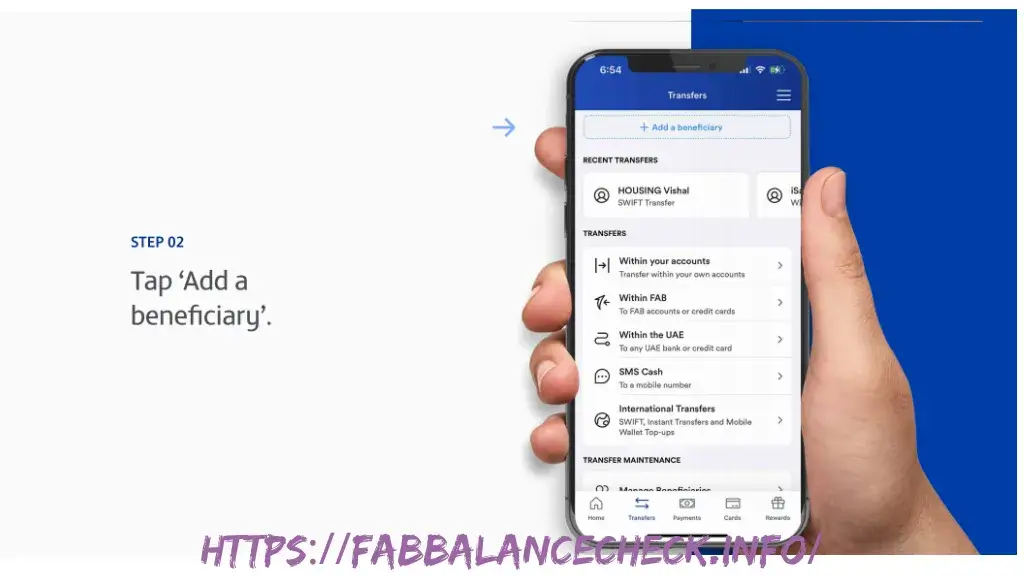

Step 3: Select Add New Beneficiary

In the Beneficiaries section:

Choose the most suitable type based on your transfer needs.

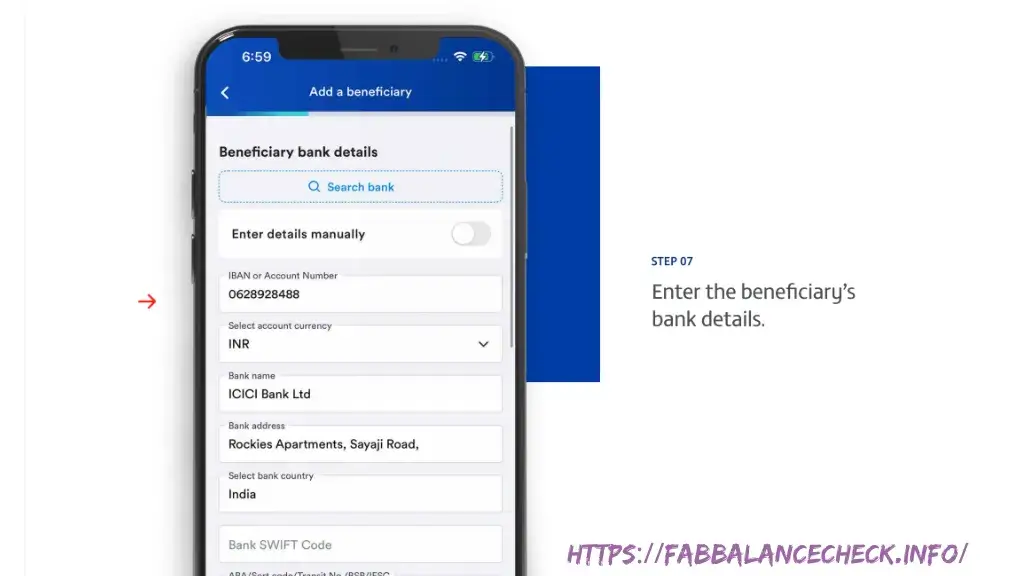

Step 4: Enter Beneficiary Details

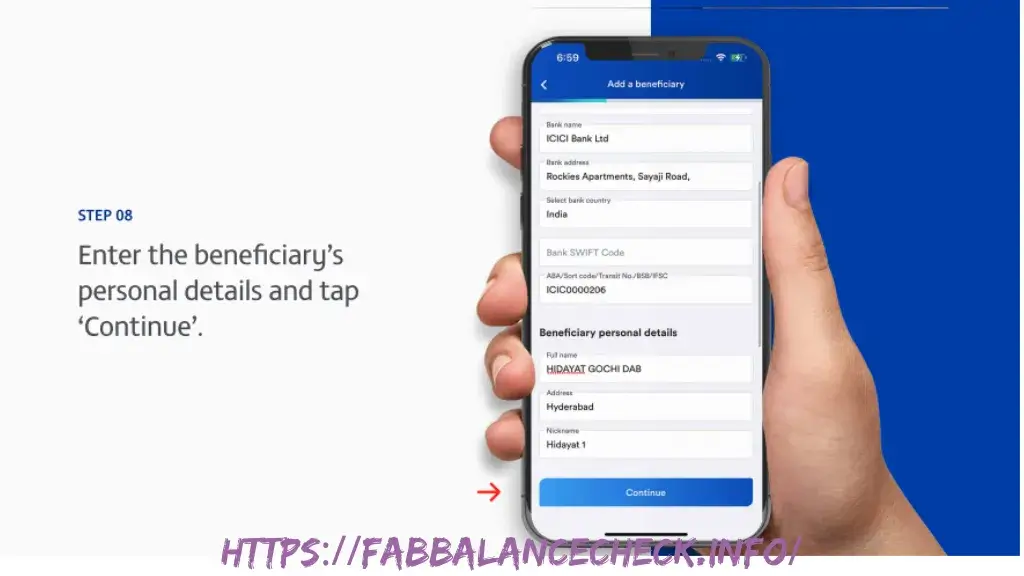

In the next step, you will be required to enter the following information of the beneficiary:

Make sure all details are correct in order to avoid issues during future transfers.

Step 5: Verify the Beneficiary Details

After entering all the required information from the above steps, the app will prompt you to review the beneficiary details:

Step 6: Authorize and Add the Beneficiary

Once you have reviewed the beneficiary details, do the following steps:

Finally, the beneficiary will be added to your list, and you will be able to make transfers to this person or account going forward.

Important Points to Remember

- Beneficiary Approval Time: Once you add a new beneficiary into your app, it may take a few minutes or sometimes a bit longer for them to be activated. Once that is approved, you will receive a confirmation notification about it.

- IBAN Accuracy: Make sure the IBAN or account number which you provided is accurate, especially for international beneficiaries in order to avoid transfer failures.

- Secure Transfers: Adding a beneficiary to your FAB Mobile app ensures that the future transactions are secure as only your authorized contacts can receive funds.

| Step | Description |

| Step 1: Log in to the FAB App | Open the FAB app and log in using your username and password. |

| Step 2: Go to Beneficiaries | Go to the Beneficiaries section under Payments & Transfers. |

| Step 3: Add New Beneficiary | Tap on “Add New Beneficiary” and select the type of it (Local or International). |

| Step 4: Enter Beneficiary Info | Enter the beneficiary’s name, bank details, IBAN/SWIFT, and reason of transfer. |

| Step 5: Verify Details | Review the information that you entered and confirm it is correct. |

| Step 6: Authorize Beneficiary | Complete verification by entering the OTP sent to your registered mobile number. |